13 Mar 2022 SPX Weekly - FOMC

Accuracy: 11/14 (78.57%)

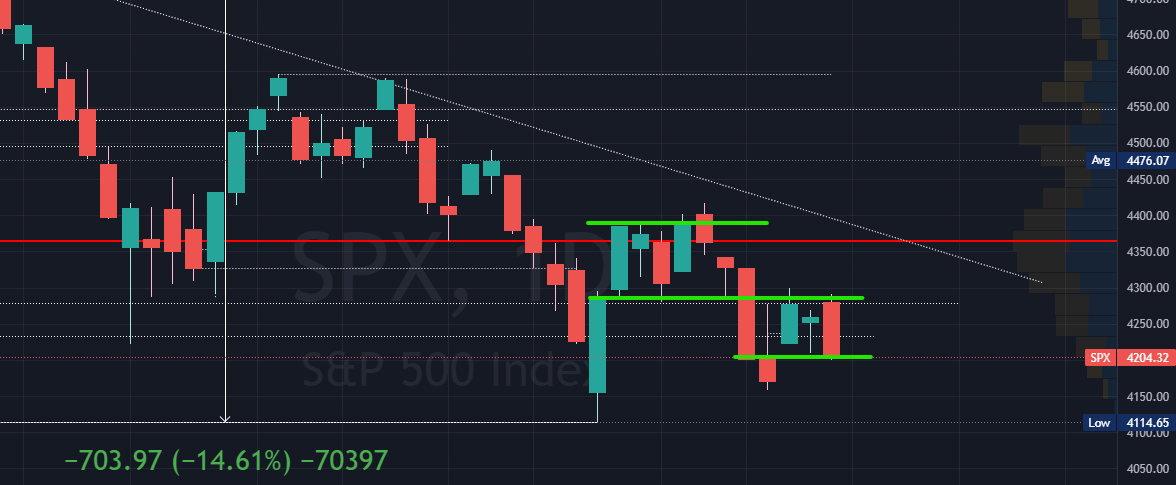

SPX above 4230 - Wrong

Last Week

So it's the 3rd wrong prediction I had so far. Since the start of the week, SPX broke below 4300 and stayed in the new lower range of 4200-4300 for the week.

Despite some slightly good news I expected, price still loom towards the downside for a bit. CPI did meet expectation, we did had an initial up move but it didn't last. Russia Ukraine talks starts but didn't progress well.

The ongoing war and sanctions continues to push the market down slowly, maintaining the overall downtrend and closing Friday right at the 4200 area. One of the key factor market is still going down is due to Oil prices going up, which is caused by the ongoing war.

Looking at the 30 minute chart, the previous support range around 4280-4300 the week before becomes the resistance last week. This also further confirms the downtrend continues.

On the 5 minute chart, we see that after Monday's break down below 4300 it finds this new range for the week and close towards the lower half of this 4150-4300 range.

Upcoming Week

So what to look out for in the upcoming week. On the upside, the downtrend resistance line remain the strongest trendline to hold. Which from my projection to the end of the upcoming week, it's around the 4360 area. For downside, the previous lows is around 4114 to 4150.

With all the bad sentiments still lingering, it seems that the market makers are still trying to push down price further. It does seems slowing down but we're not sure when are we going to see the bottom.

One lesson to remind myself from last week's wrong prediction is, the bigger time frame trend often has more strength and only after a clear reversal confirmation then we change side to follow the new trend.

From technical perspective, I expect the downtrend continues with some up moves to find resistance at 4250 area.

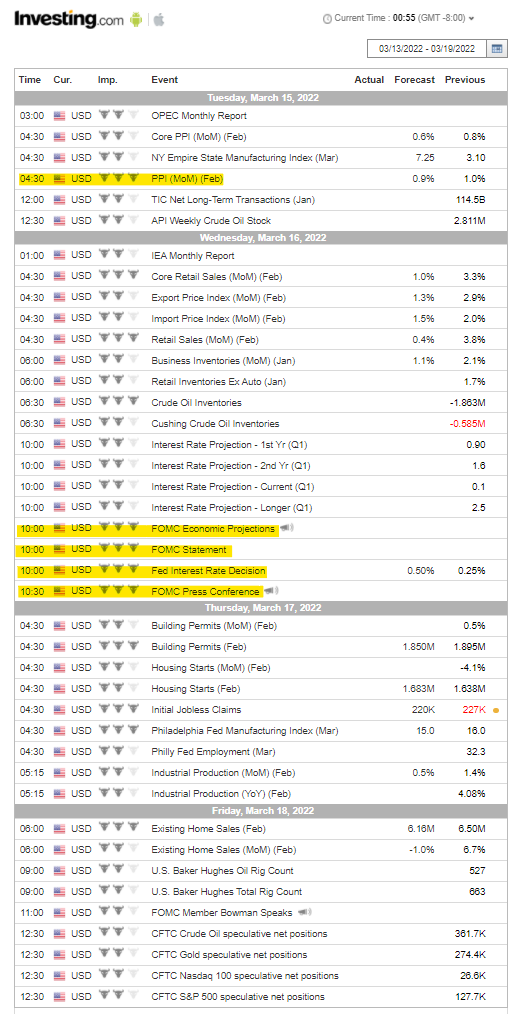

Economic Calendar

Next week, all eyes on FOMC. Although things are pretty much transparent and expected, no one knows what kind of details from the FOMC conference will move the market. Market makers and algo traders picks up the little details from such big event and the market instantly response to it.

It's really hard to say which direction this FOMC will drive the market to but I remain bearish on trend and on all the ongoing downwards bad news pressure until we see prices breaking the downtrend resistance line.

Prediction

4370 is the projected trendline at coming Friday.

SPX below 4370

Member discussion