16 Apr 2023 SPX Weekly - Earnings

Accuracy: 57/63 (90.47%)

SPX above 3900 - Correct!

Paper Trade

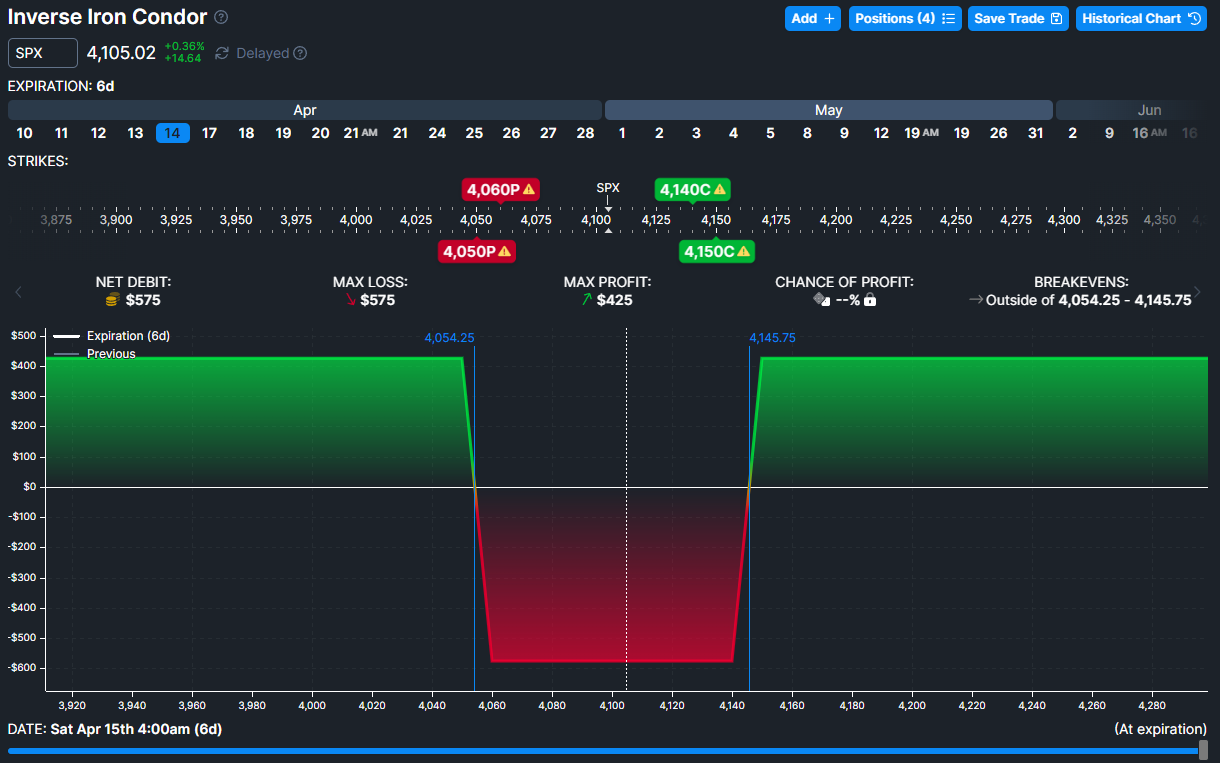

SPX closed at 4137, right below my call strike. So close that on Friday we actually got above 4160. Anyway it's paper trade, means a full loss of $575 as shown.

Last Week

What happened was CPI no longer caused as big as a move compared to several months back where all the inflation related news caused big volatile movements in the market. This time, maybe also due to VIX is being low nowadays, SPX only moved slightly on these news.

SPX did break above the recent previous high around 4130 but came down slightly to end the week. We're still on an uptrend looking back past few weeks, still making higher highs and higher lows.

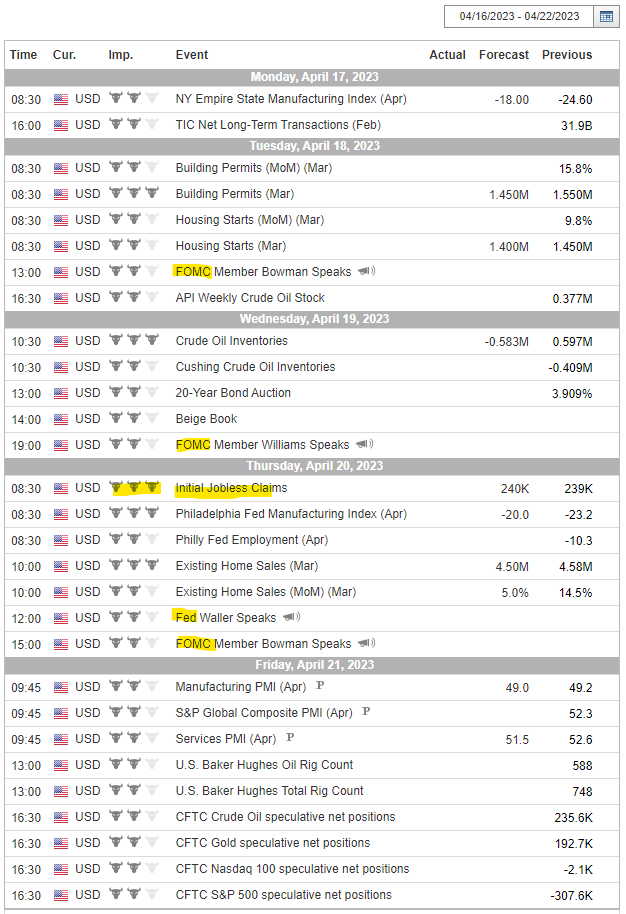

Economic Events

Nothing really huge next week on economic calendar, as usual after events like CPI or FOMC there will be several Fed/FOMC speakers talking. Since the whole inflation topic seems to start settling down when even CPI didn't do much, there shouldn't be much to watch. The banking situation is looming still though.

Earnings Releases

Right after CPI, we're back at the start of earnings releases again.

Tesla (TSLA) as usual, always leads the mega cap stocks to start the earnings releases together with a bunch of banks (GS, MS, AXP, BAC) and financial companies. We also have several big semiconductor companies (TSMC, ASML, LRCX) and some notable mentions like (NFLX, JNJ, PG).

The thing I'd be concern here continues to be whether these series of many banks earnings releases will trigger another continuation of the banking crisis effect from the previous bank run situation. So watch out on this sector.

Next Week

From last week's movement, it seems to retest the 4100 and tries to go higher. We're also on a pretty gradual uptrend of higher highs and higher lows waiting to make a new higher high. So the general expectation is still uptrend but may expect a pullback if there's any catalyst before going higher.

This time I shall use fibonacci as a reference to estimate if we were to pullback, where should we see potential support. From the fib tool, we can see it's around 3948.

Prediction

SPX above 3948

Paper Trade

Gonna try another inverse iron condor again, as I kinda expect it either moving up above 4200 for the higher high or pulling back to 3948. This gives a pretty decent risk reward ratio of $595/$405 which is 1.47:1.

Member discussion