26 Feb 2023 SPX Weekly - Support or Break?

Accuracy: 51/56 (91.07%)

SPX below 4200 - Correct

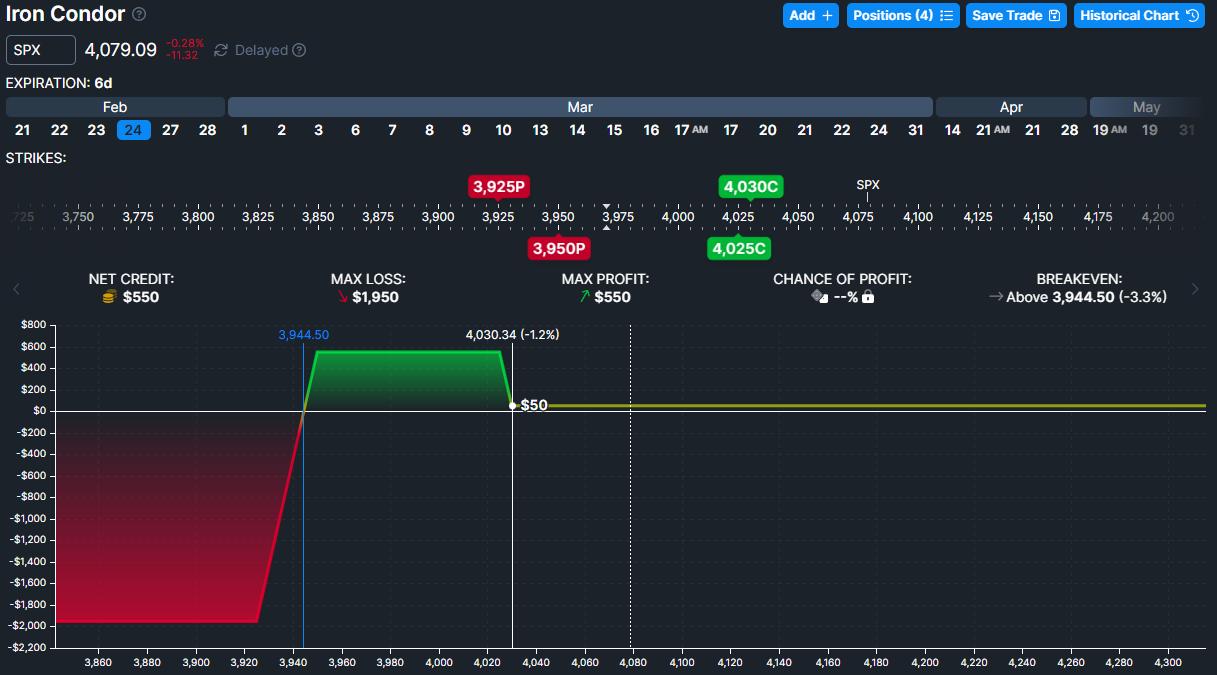

Paper Trade

SPX close 3970 which lands right in the profit hump of the trade with max profit. Quite spot on for this SPX to move exactly like how I expected.

Last Week

SPX pulled back totally like how I analysed last week right into the fibonacci 50-61.8 zone. It did break the uptrend support line on Friday, lets look into the lower timeframe to see how the price action play out.

We see a clear lower timeframe short term downtrend in the past 2-3 weeks ever since we did not make higher highs below 4200. We did struggle on the uptrend support since Thursday but eventually broke downwards slightly. Closing Friday with a small bounce back towards 3970.

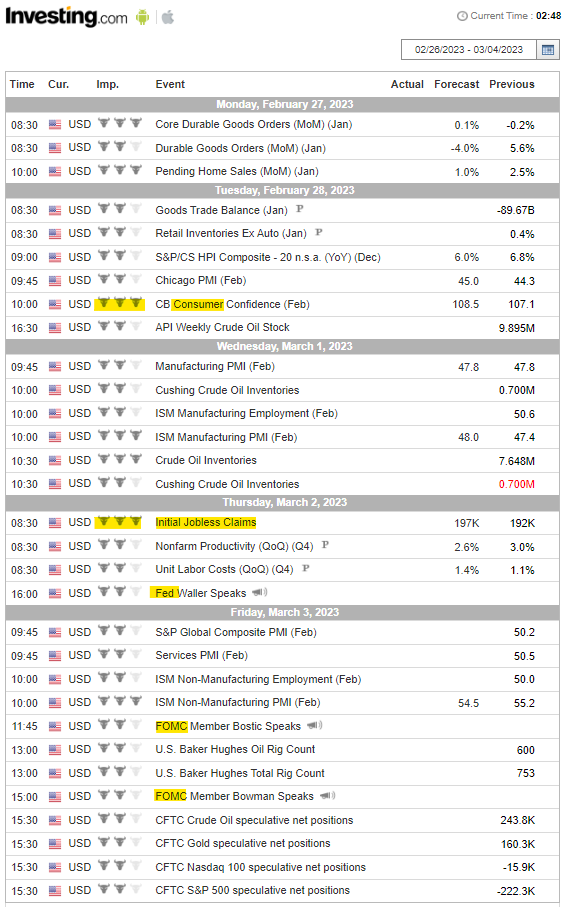

Economic Calendar

Seems like nothing very impactful happening. Usually no news is good news, so on this part I lean slightly bullish. But always expect the unexpected.

Next Week

First let's touch on some key areas.

- Green - 4100 should be the safe upside resistance

- Yellow - 3900-4030 this range falls right into the 3 key fib levels

- Red - 3800 if some really bad news come up

After 1-2 weeks of big pullbacks, I'd actually expect some ranging with no big events going on and being in the fib level gives more conviction for that. Not forgetting the most recent move is a downtrend.

Prediction

SPX Below 4100

Paper Trade

Since I kinda expect ranging, an Iron Condor fits the storyline well. Keeping it narrow at 10 wide to control the risk reward 620/380 (1.63:1). It's quite a low probability play in terms of the profit zone but with a controlled risk reward, risk management is in place. Always trade with the mindset of being ok to lose and be wrong.

Keeping it 10 wide also makes the trade less management required, set and forget and wait for it to expire. This also frees up the mind from emotions which often happen managing trades. Let's see how it plays out.

Member discussion