26 Jun 2022 SPX Weekly - Bounce

Accuracy: 22/27 (81.48%)

SPX Above 3500 - Correct

Last Week

SPX pretty much bounced up as expected, just that it was a much stronger bullish bounce than I thought.

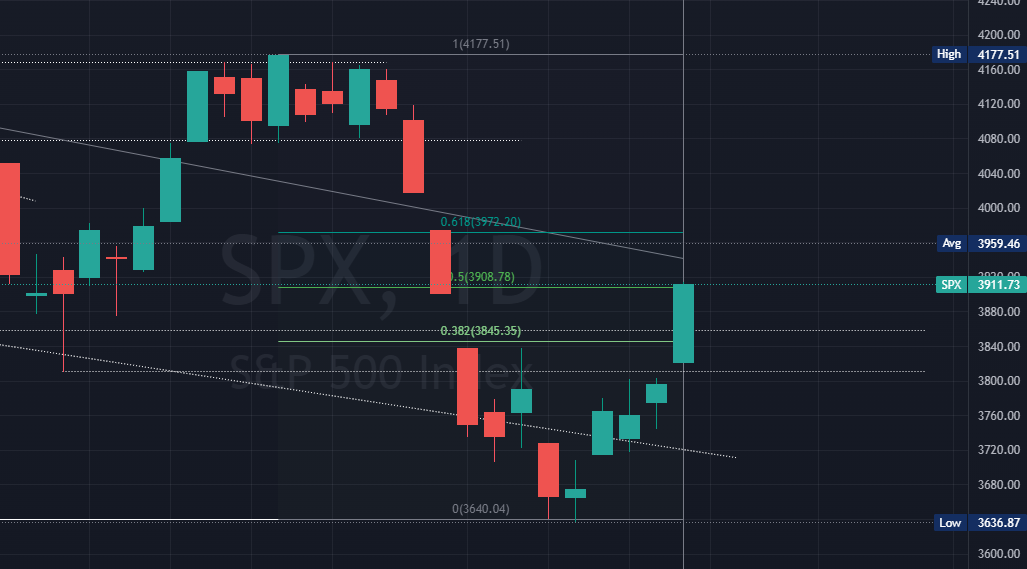

We almost had an entire week of bullishness with a super strong Friday. With that, reference to the Fibonacci I drew in last week's post we are at the 50% of this Fib.

Taking a step back, zooming out, so we don't forget we're still on a downtrend with this regression trend line drawn. We did close last week with a strong bullish engulfing candle.

Although we are kinda 'taught' that bullish engulfing candles are signals to long trades but we need to remind ourselves to look at the bigger context. We are still on a downtrend now and in the past few bullish engulfing candles that happen in a similar situation, we didn't really had strong continuation up moves. Instead, it either slow down or rejects.

Next Week

So for next week, we need to keep in mind this recent pattern. I'd say we do expect momentum to continue or slow down more than immediately rejecting all the way down.

With that strong Friday run, I'll probably not go against the last momentum move. I will then look at the 3800 as the possible support area which has several past support resistance confluence.

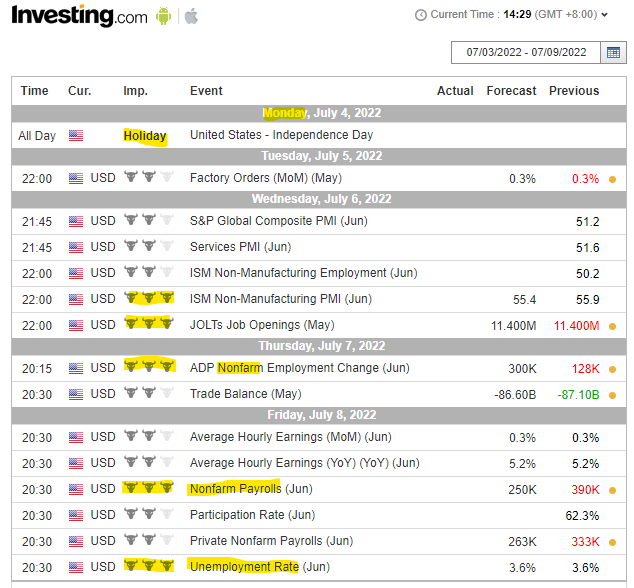

Economic Calendar

It's also going to be a short week next week with Monday Holiday. Putting together the technical analysis and upcoming events. It seems we should at least see some continuation of momentum up since there's not much volatile events.

Probably towards the later part of the week when the inflation related data points get release, we will see more volatility. Then again these are scheduled and predictable events upcoming, there could also be unexpected events in the news that will move things otherwise. But we can only know what we can figure out to make the best decision out of it.

Prediction

Pretty simple and less happening weeks recently I'd say, compared to the times where we got all sorts of news and anticipation going on especially near FOMC and CPI data events.

I lean towards SPX hovering and ranging in the current 3900 area, follow the latest momentum trend.

SPX above 3800

Member discussion