28 Aug 2022 SPX Weekly - Rejected

Accuracy: 29/34 (85.29%)

SPX below 4400 - Correct

Last Week

I already have that analysis and market sensing that it's going to reject and it did. But it was due to something unexpected. If you look at my last week's post on the economic calendar, Powell speech wasn't planned yet. It's until Wed or Thurs then that event was announced. Which right after Powell speak on Friday, market breaks all the way to the downside on.

Look at how nicely SPX is going to make a reversal on Tues and Wed, so ready to build up and bounce upwards. Thanks to Powell, the whole narrative reversed.

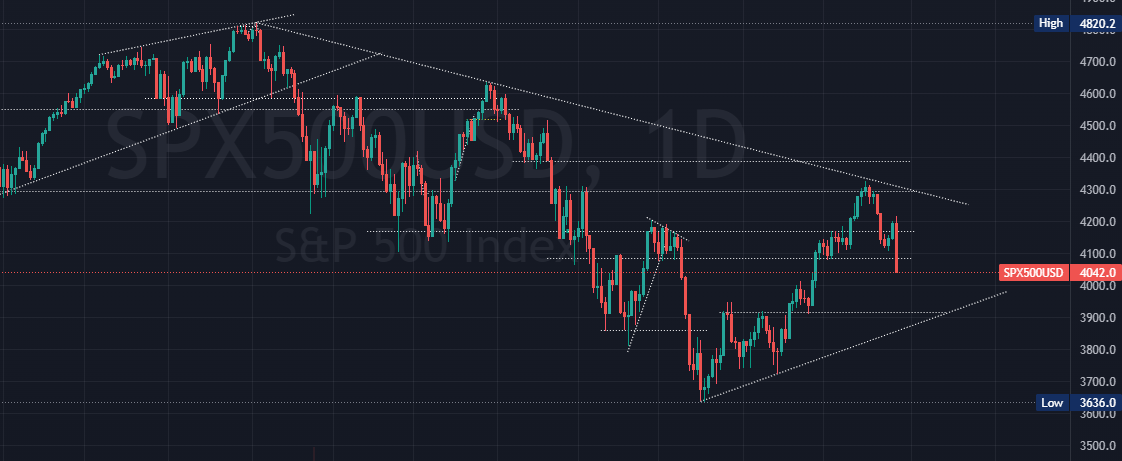

Let's take a look at the daily candle chart, this downtrend resistance is pretty well respected and it seems like the market is not that ready to break it yet. Friday's candle showed such strong bearish momentum with one of the biggest red candle since June.

Next Week

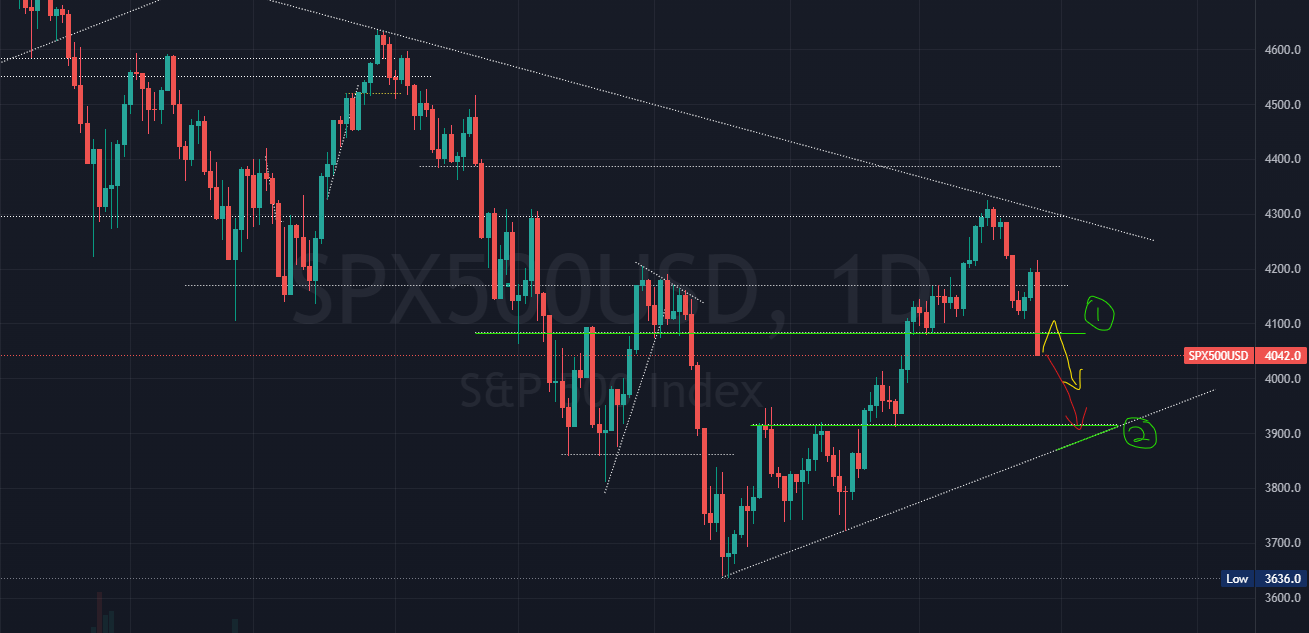

Friday we broke downwards through the nearer support (1) around 4100 with a strong bearish candle. From here the next support we're looking at is near the 3900 area. With this whole market bearish sentiments and momentum, this bearish move will high likely continue towards 3900 which also kind of meet the uptrend trendline drawn from the 2 previous lows.

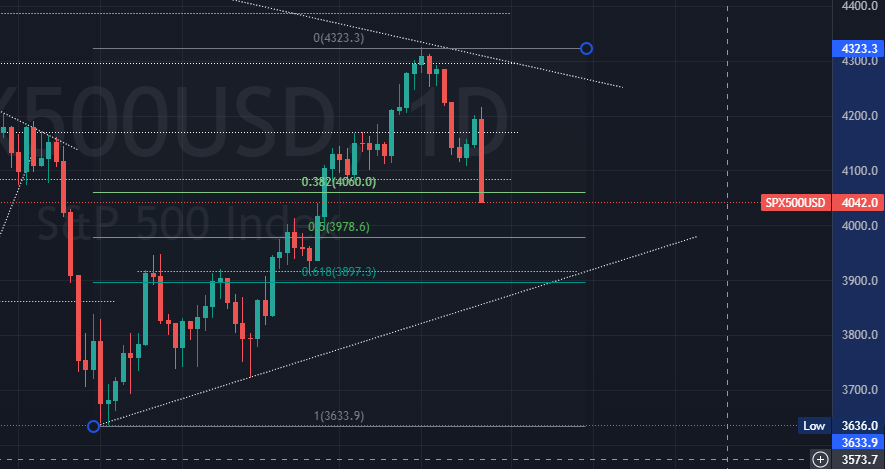

To add on another confluence with the Fibonacci indicator which I often use, from the lowest point to the current swing high. The 3900 area also happen to be the 61.8% fib area. This adds a little more conviction that the market will target this area.

Actually 2 weeks back when the market hit the downtrend resistance I'm already thinking this bullish run up is a little too steep and needs to cover up some imbalance on the way up especially at the 4000-4100 area. But the whole market reversal sentiment was so strong that makes me think otherwise that, maybe not this time. But there we go, it does seem smart money concept will eventually play out. The imbalance created during the up move will often have to be filled. Market makers have to push the price down to cover their position before continuing where they want to go. While the only unknown is we don't really know when will it happen.

So from here, next week I'll be looking at price moving towards 3900. Maybe breaking below 3900 slightly before rejecting. I don't think it will go all the way through towards 3800-3700 at least for next week.

Economic Calendar

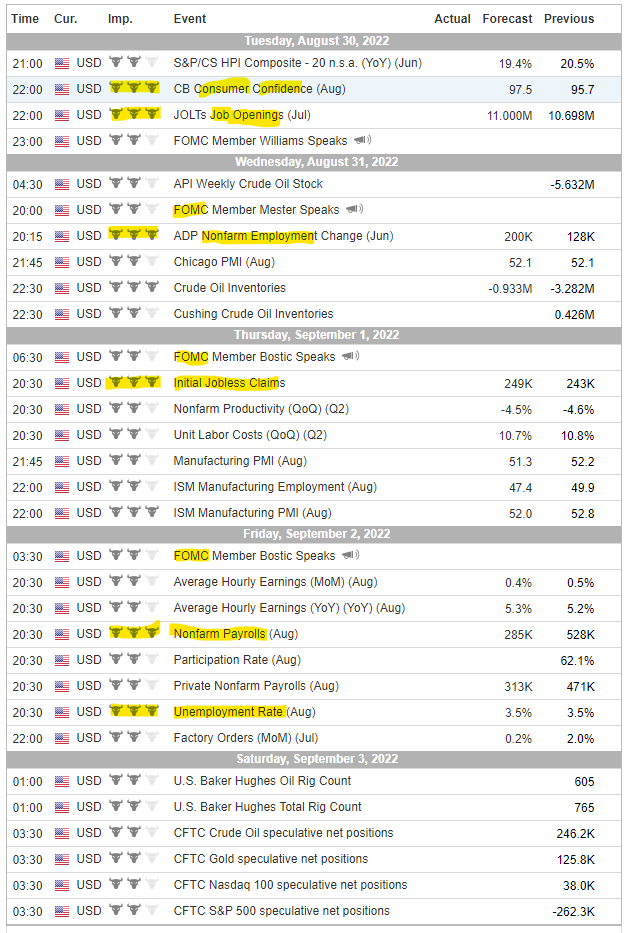

The economic events next week also pretty much adds on to the same volatile sentiment with inflation and jobs related topics almost every day. These FOMC speakers are going to cause more market moves as well.

Prediction

I'll take the recent high, which was the downtrend resistance rejected high, as the key resistance that SPX will not break this point within next week.

SPX below 4320

Member discussion