30 Jan 2022 SPX Weekly - Bull Taking Over?

Accuracy: 6/8 (75%)

Last Week

My prediction that SPX stay below 4600 stayed relatively safe. Adding another correct prediction to my statistics. I actually wanted to call for below 4500 last week but with the highly volatile events and situation we are in, I went for a safer and further prediction.

Looking at what happened last week, it was basically a week of consolidation. With Monday rejecting the swing low in October 2021. It was really an eventful week, with FOMC and mega cap earnings I mentioned in last week's SPX weekly post.

The market didn't really liked what Powell said in the FOMC announcement, specifically in the Q&A session despite there wasn't any surprise in the statement itself.

On the earnings side, we had AAPL MSFT V holding the market up. Closing the week with a beautiful bullish engulfing candle on Friday after the 12.37% correction from the December 2021 all time high.

Upcoming Week

On the daily chart candle, we can see the rejection off 4300 area and closing a strong bullish candle. Technically we should expect the continuation of momentum.

Going in to the 15 minute chart, we see a very important technicals. On Friday, SPX broke the larger time frames downtrend resistance line. This might be a strong signal to the upside.

Back to SPX daily candle chart, we are potentially looking at around 4550 as the next area of resistance.

Just to top it off, the 4550 area is also around the fibonacci retracement area of 50%-61.8%.

So from a technical analysis perspective, I'm looking at a slightly bullish lean move towards 4550 area. Not forgetting we still have economic calendar and earnings that's happening next week.

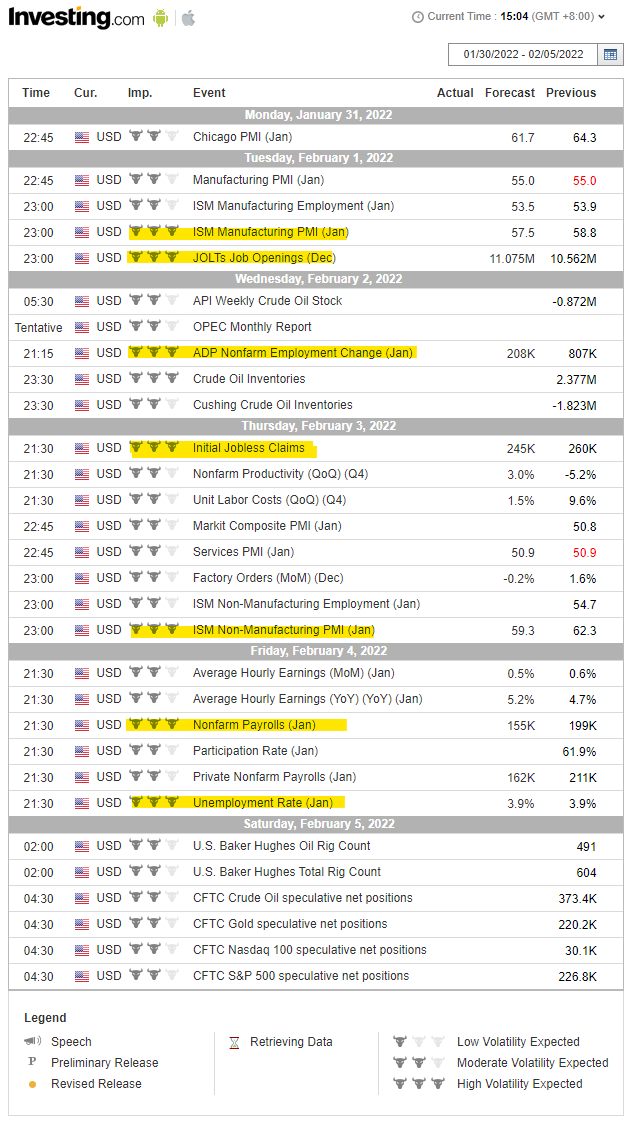

Economic Calendar

We do have quite a happening week with Tues to Fri all having 3 star volatility events. We have to keep in mind that in the current inflation sensitive context, with Feds talking about interest rate hikes and balance sheet.

Quite a number of next week's event account for the Fed's decision in March. Although these are not the biggest factor like CPI but they all adds up and can move the market for few days before the much awaited March FOMC.

As these events are smaller factors, I do hope they don't cause as much volatility and we should have some slight upwards recovery. At least a breather.

Earnings

Since it's earning season, lets not forget about it.

There are plenty of big names coming up next week. But those that can really move the market are the mega caps like FB AMZN GOOGL. Since AAPL and MSFT, we really do hope the momentum continues from these earnings. Which aligns for at least some recovery after such a bearish start in January.

Prediction

With all the above sentiments slightly learning towards a slight bullish next week. My prediction will be:

SPX to stay above 4300 by end of next week.

Member discussion