5 Mar SPX Weekly - Bounce

Accuracy: 52/57 (91.23%)

SPX below 4100 - Correct

Paper Trade

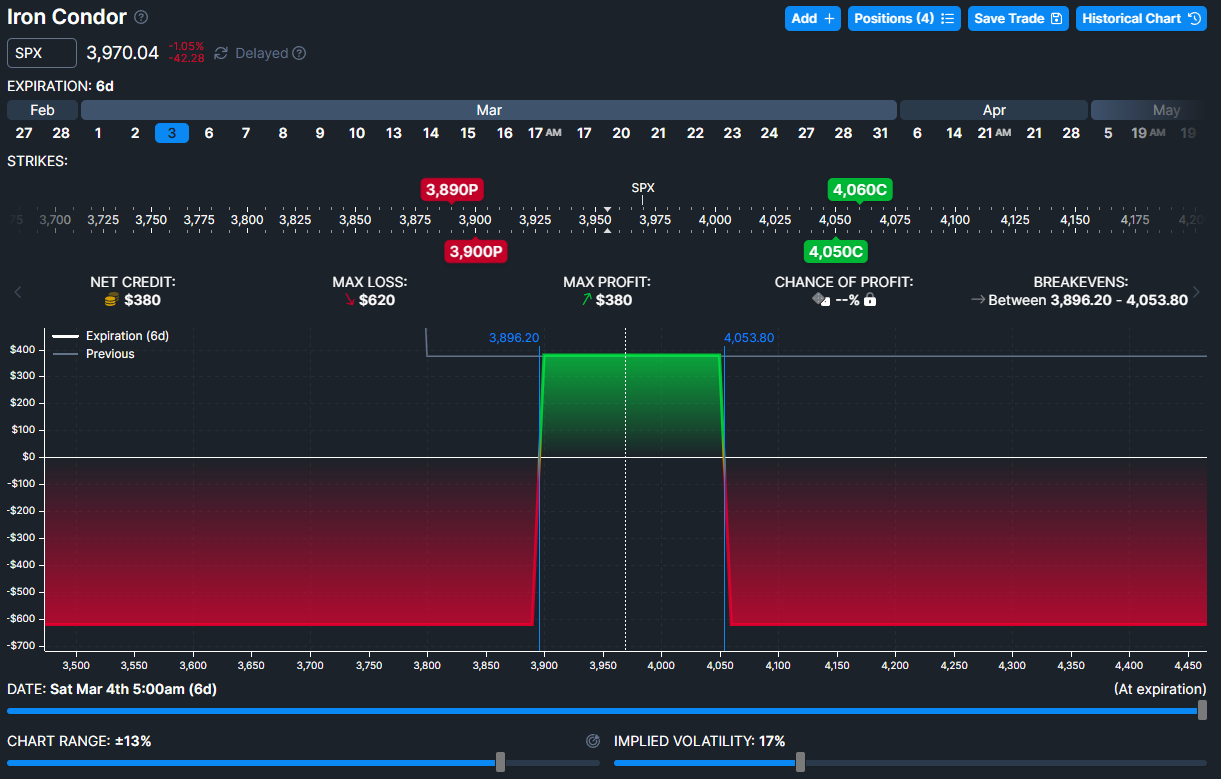

SPX close in the iron condor despite friday's bullish run because the week started moving downwards. So it's full credit profit.

Overall it played out pretty well as I predicted. Such paper trade can actually be fun practicing.

Last Week

SPX finds support in the key are I anticipated, mainly the fibonacci 61.8 zone I mentioned for the past 2 weeks.

See the bounce off the fib levels so nicely following by a super strong bullish candle to finish Friday.

Just to share abit some new perspective. SPX moved down pretty strongly 2 weeks before, then slowed down into consolidation for 1-2 weeks and finally making big moves upwards.

This whole pattern is something that repeats in the market again and again. These are typical stock cycles. What we just had is a mark down, accumulation then mark up.

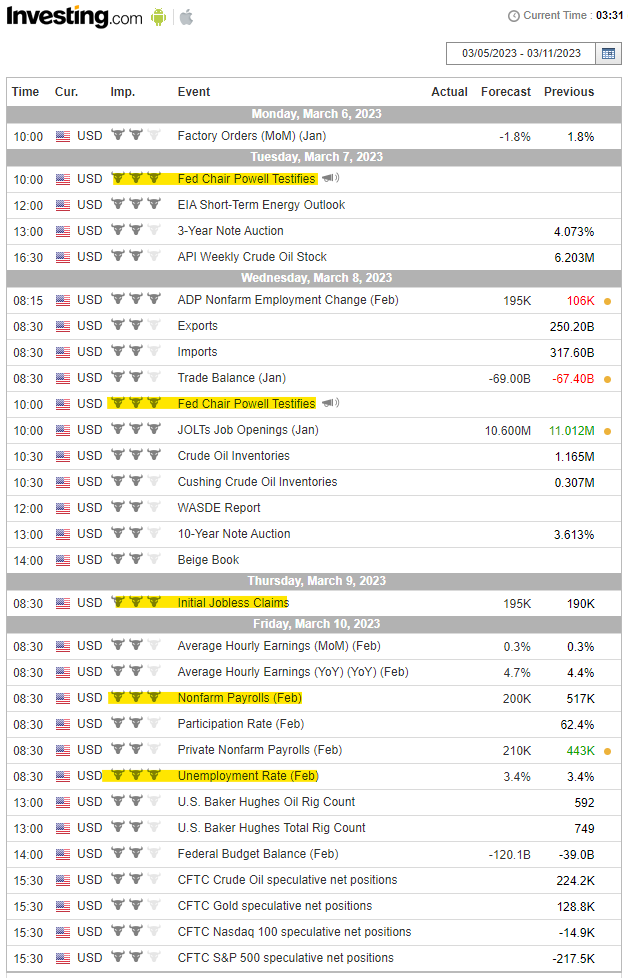

Economic Calendar

Looks like we've got a rocky week ahead with Powell testifies for 2 days right after market open. Thurs/Fri we have the regular jobless claims and nonfarm payrolls.

Next Week

With Friday's rally, we see obvious break of lower highs and significant reversal momentum. As always market will not go in one direction nonstop, it needs a breather every wave.

Green - 4050 - 4100, If we continue this bullish momentum, this will be the near area to slow down and might go into the distribution phase.

Yellow - 3980, this might be the potential pullback area before going higher, it's also pretty near the fib 50-61.8 levels

Red - 3920, the significant previous low, this would actually be my area of importance since I'm looking at a reversal play.

Prediction

Reversal but a potential pullback near yellow.

SPX above 3900

Paper Trade

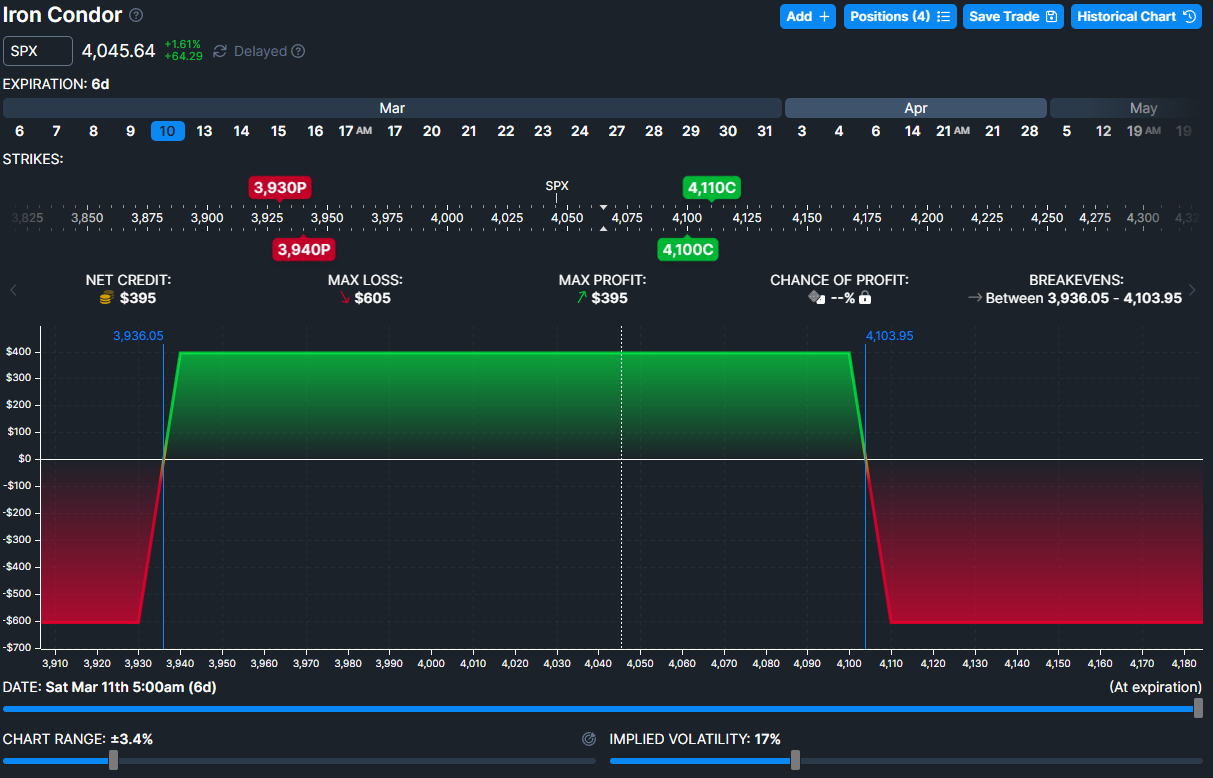

I'm doing another Iron Condor with a decent risk reward ratio of about 1.5:1 marking off the strike with my key support/resistance area of 3940 and 4100.

On the lower side, I would actually want to go lower than 3940 but I think I'm ok to with putting some risk on to get a better risk reward ratio. While on the higher end, 4100 is the next important high to break which I believe after big moves there will be at least some pulling back hence slow down the upside move.

These 2:1 Iron Condor seems pretty simple because they are pretty much set and forget kinda trades. I might look into exploring these into daily trades, it's like setting your goal poles for next week to let it fall into. Kinda fun.

Member discussion