7 May 2023 SPX Weekly - Sell in May?

Accuracy: 60/66 (90.91%)

SPX above 4050 - Correct!

Paper Trade

This is an interesting paper trade last week. I said if SPX were to reach 4080, let's take it as a 2:1 risk reward loss of $1000. And SPX did pulled down all the way to 4050 and rallied back into 4136 on Friday. Feels like a trade taken out and reversed, haha. But well it's paper trade, so it's quite a fun experience still.

Comparing this trade with the previous few I did where it's a plain simple iron condor that is set out to expire regardless, the key difference is trades that require management are harder to deal with. Be it managing it right or emotionally deciding what to do while in the trade. For me the simple defined risk reward approach seems to be more sustainable long term, set and forget, move on.

Last Week

On the daily candle chart, SPX rejected from the start of the week all the way down to 4050 which is exactly the previous low just the week before. Followed by a strong friday rally probably thanks to AAPL's earnings release after thursday market close.

While I was expecting the momentum to follow through and break above 4200, it seems that we're experiencing some struggles at this level.

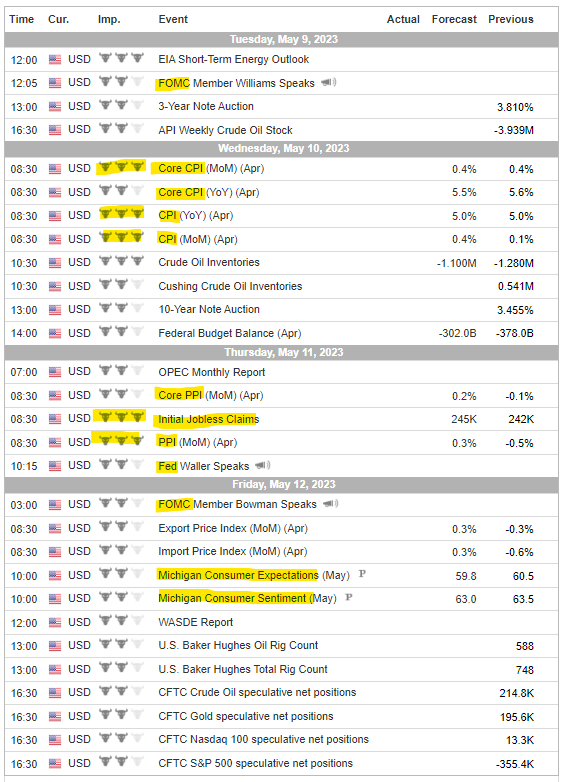

Economic Calendar

Once again we have our CPI after FOMC week. Several Fed and FOMC speakers. Personally I find the whole volatility caused by inflation seems to have toned down alot compared to last year. A lot of it are pretty much within expectation and anticipation. Unless we have surprises, we should still see volatility but probably smaller.

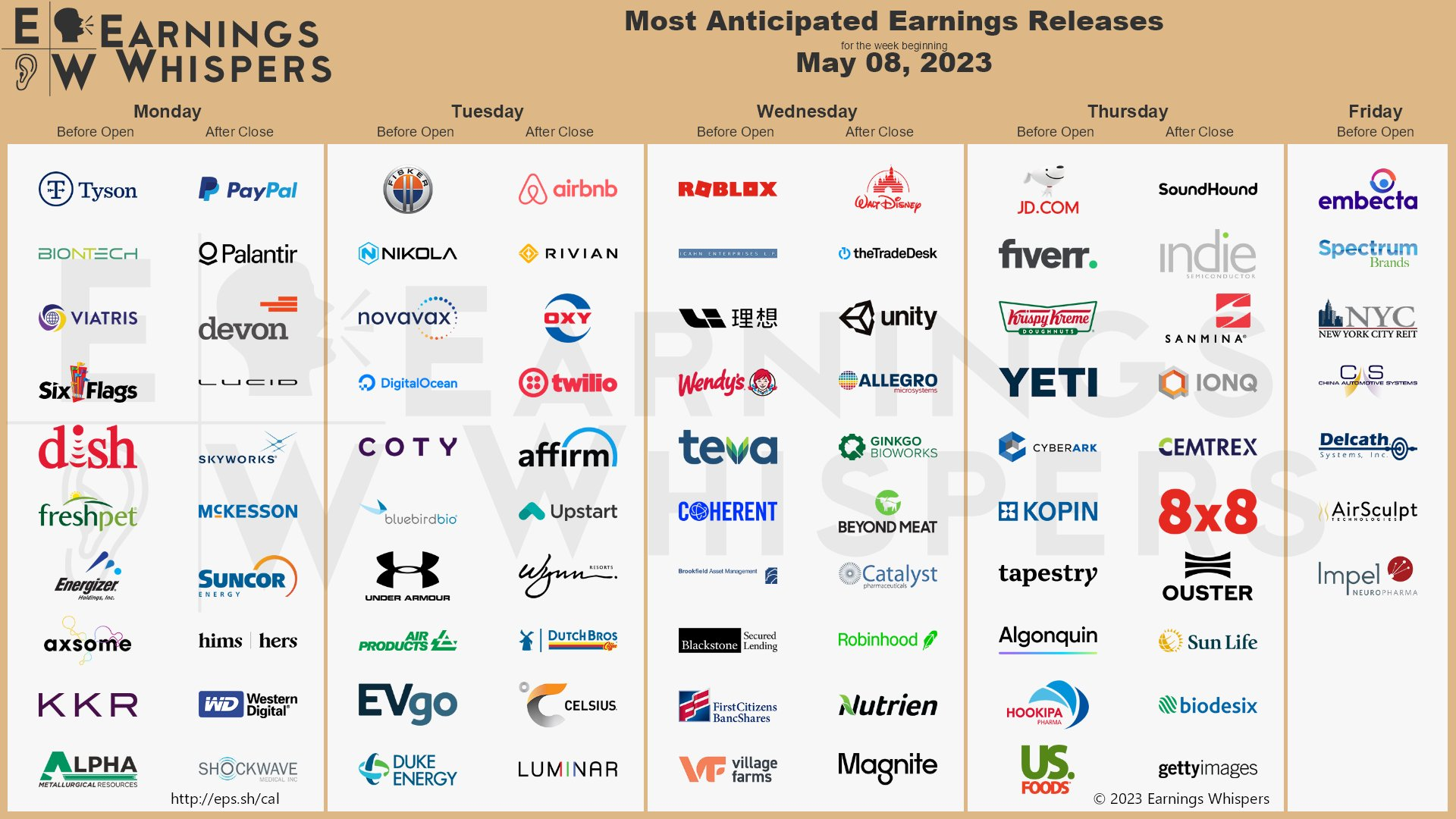

Earnings

Still quite a number of large cap tech stocks releasing earnings after the giants are done. But should be not enough to be the key movers.

Bank Crisis

The bank crisis still seems to be the biggest volatility factor these few weeks. More banks falling, more news around the whole bank sector causing more fears. Instead of the interest rate vs inflation, it's not interest rate vs banks survivability now. As the increase in interest rate is the main factor why banks are falling, specific reasons I shall not go in. It's a comprehensive financial story there.

Next Week

Using the 30 minute chart, the key support resistance area is pretty much clearly seen in daily chart as well.

Green - 4200

Yellow - 4050

Red - 4000

The pull back to 4050 did not really caused a lower low, more like a double bottom. So the uptrend still seems valid. I'll expect it to stay in this 4050-4200

range and if any preferred side, friday's momentum would be the direction.

Prediction

SPX still above 4050

Paper Trade

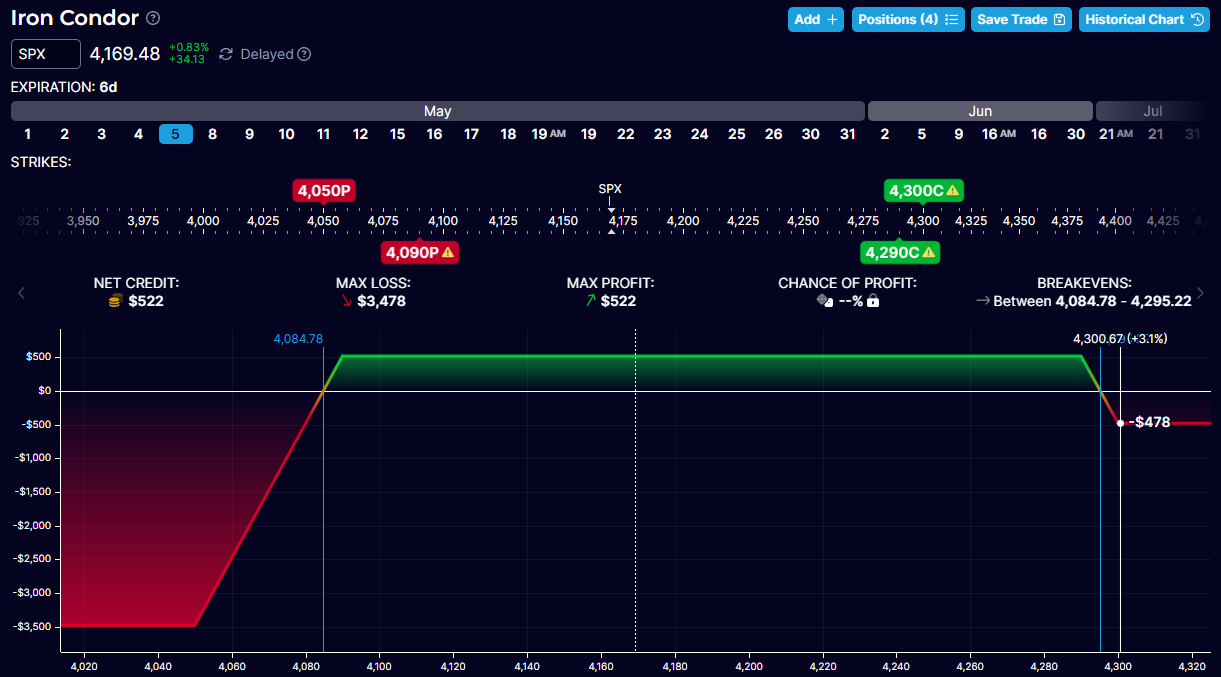

Went back to the simple credit iron condor, this time with a higher risk reward ratio of 2.28:1. Strikes are exactly at the support areas I've drawn in the above chart 4050-4200. It does seems that the current VIX environment is getting lower and strikes are nearer compared to few months back.

Member discussion